10 Questions asked by Australians Living in New York

On Wednesday, June 14, 2017, The Australian Community held a private networking event at Bluestone Lane’s DUMBO location in New York to record a video of the Top 10 Questions asked of The Australian Community.

Some of the answers captured in the thirty-minute video revealed a number of common mistakes (and incorrect assumptions) made by Australian expats living in New York and the broader US.

The Australian Community does not offer specific Legal, Tax, or Immigration advice. The questions and information discussed in the video are based on an aggregation of Australian Expat experiences, and as such, your experience may differ.

Click to watch the full video below.

If you have a question that effects your Health, Finances, or Liberty, The Australian Community strongly recommends that you seek professional guidance.

Below we have listed the questions with links to relevant content, as well as the option to Fast Forward to the question on the video.

The Questions are:

10: What is Dual Intent and how does this effect entering the US on a non-immigrant visa? – FF to question.

9: How do I find work? – FF to question.

8: Can I use Airbnb to supplement my income if I am on a non-immigrant visa? – FF to question.

7: Can you work for two employers on an E-3 visa? – FF to question.

6: What is the Substantial Presence Test? – Learn more on our Podcast. – FF to question.

5: What is FBAR and FATCA? – Comparison of Form 8938 vs FBAR – FF to question. Contact us to be connected to professional assistance with filing a late FBAR.

4: How do I rent an apartment without a Credit History? – FF to question.

3: How do I access and build US credit? – FF to question.

2: Who has the best FOREX Rate? – FF to question.

1: What is the most common Expat mistake? – FF to question.

As mentioned in the video, our website and private social network collectively contain our knowledgebase of overcoming the challenges faced by Australian Expats.

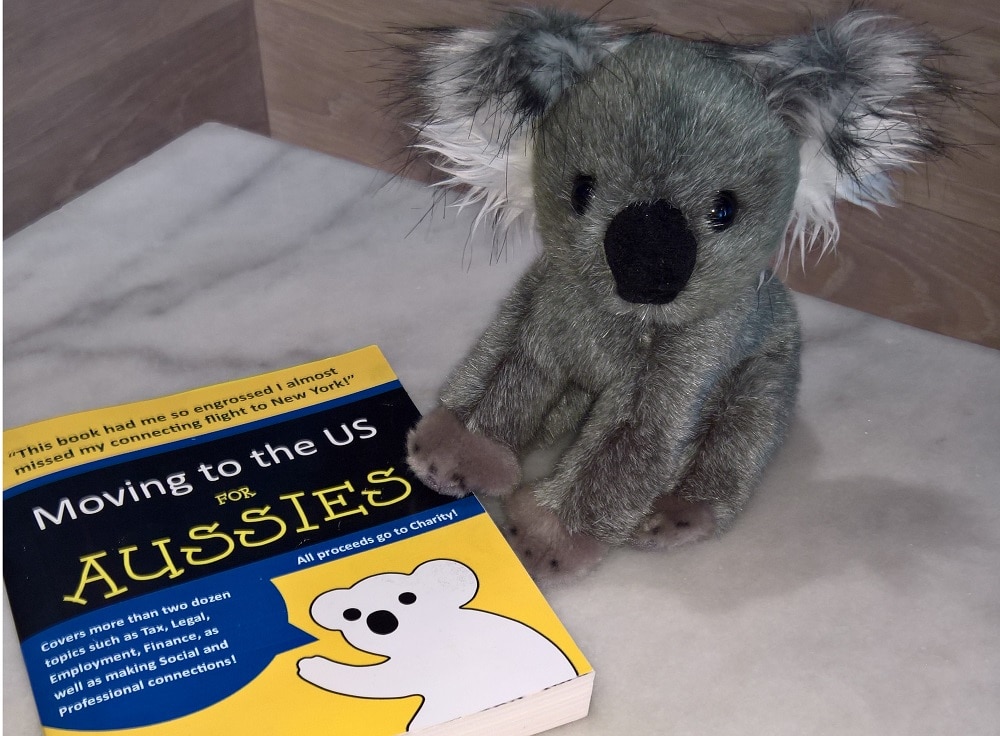

Read more in our book “Moving to the US for Aussies“.

About The Australian Community

Founded in 2011, we connect more Australians in America.

If you are a professional Australian taking your career to the next level, or the U.S. is the next step in your company’s global expansion, we can connect you to all of the resources you need for success in America.

Learn more and Join The Australian Community.